The purpose of this learning module is to explain how to read a flood insurance rate map and a flood insurance study. Since the 1970s, FEMA has been creating, storing, and updating flood hazard maps for the NFIP communities across the United States. Flood insurance rate maps, or FIRMs, are the primary tool for governments to mitigate the effects of flooding in their communities. They are intended to reduce future damage and provide protection for property owners through an insurance mechanism that allows premiums to be paid by those most in need of protection. These maps show areas subject to flooding based on historic meteorological, hydrologic, and hydraulic data, as well as open space conditions, flood control works, and community development features. Common physical features such as major highways, secondary roads, lakes, railroads, streams, and other waterways are included on a flood insurance rate map. Special flood hazard areas, or SFAs, also known as flood zones, base flood elevations (BFEs) or depths, and flood insurance risk zones such as AE and X are indicated on the maps. Additionally, areas subject to inundation by the 0.2% chance or 500-year flood are shown in Zone AEs only. FEMA distributes maps to many users, including citizens, insurance agents, real estate brokers, community officials, lending institutions, and federal agencies. Flood maps play a role in the administration of floodplain management regulations, mitigation of flood damage, and determination of whether insurance is required. To prepare these maps, FEMA and its cooperating technical partners, such as the Kentucky Division of Water, conduct engineering studies referred to as flood insurance studies (FISs). The information from these studies is used by engineers and cartographers to delineate special flood hazard areas on the flood maps. These areas are subject to inundation by a flood that has a 1% or...

Award-winning PDF software

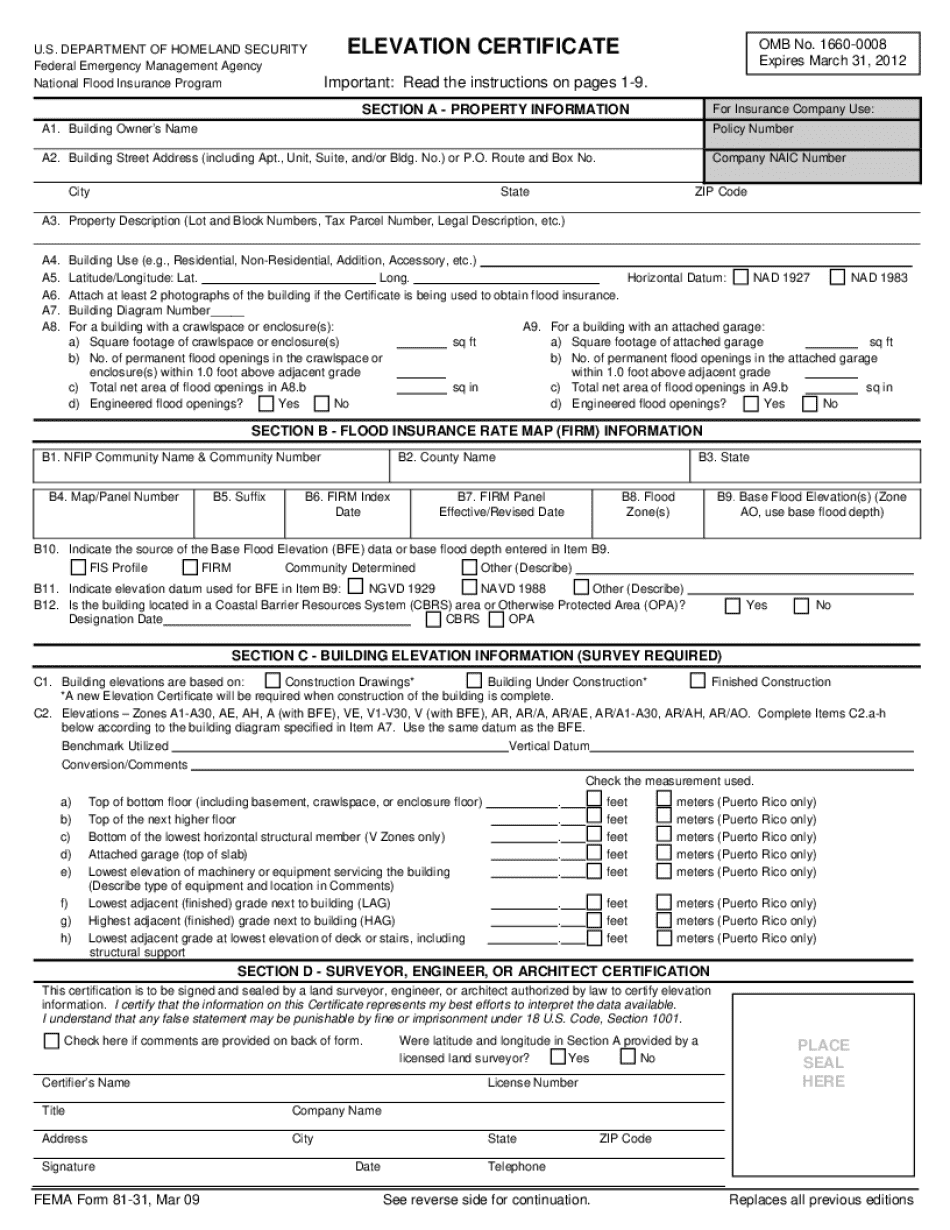

How to read a Flood Elevation Certificate Form: What You Should Know

Misunderstanding and confusion in completing the V Zone Certification (Sample) and the EC. This EC may be required at a subsequent property inspection or upon application for a FEMA Hazardous Sites Certificate. A Water Hazardous Materials (WHM) certificate is included with each FEMA-Issued (I-40) Hazardous Materials Permit or Special Permit. In the case of any special permits issued under Section 7(A)(1) (1)(a), (2)(d), (3)(a), (b), (c), (c)(1) or (c)(5) of the Special Emergency Operations and Work Zone Permit Program, they shall include the specific information On-line instructions for the V Zone Certification (Sample) VZ-ELEC-10-R001-01 The VZ-ELEC-10-R001-01 is for the public to assist individuals conducting inspection of residential residences and public buildings to properly complete the VZ-ELEC-10-R001-01. The V ZONE Certification (Sample) will be provided when requested by the Director of the Hazardous Materials Special Permit Program. This document is an example of how to correctly complete the V ZONE Certification. What is the V Zone Certification? The VZ-ELEC-10-R001-01: Flood Insurance Rate Map (FIRM), is the Federal flood insurance map of flood risks. It provides a general understanding of the flood hazard and its extent. The V-ZONE-Certification of a property is a map indicating the extent of the flood hazard and the required flood insurance rate. It should include the following information if it has been granted a V-Zone Certificate: What is the Flood Insurance Rate? The Flood Insurance Rate is the cost which insured home and business owners face when the actual flooding occurs. The flood insurance amount is not a fixed percentage but is based primarily on the level of risk in a given area as determined by the FEMA-DHS Hazardous Property Database. Flood Insurance rates change every year with significant increases in flood risk in some areas. The rate for a particular area can be found in the FEMA-Approved National Flood Insurance Map (FIRM). The rate information is determined following three factors: 1. The level of flood risk for residential, noncommercial, and commercial properties; 2.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FEMa 81-31, steer clear of blunders along with furnish it in a timely manner:

How to complete any FEMa 81-31 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FEMa 81-31 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FEMa 81-31 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to read a Flood Elevation Certificate